The self-driving future could either replace drivers or turn ride-hailing into something much bigger.

Robotaxis once felt like distant sci-fi, something always promised but never quite arriving. Now they are operating in real cities, carrying real passengers, and forcing ride-hailing companies to confront a future they helped predict but do not fully control.

For Uber and Lyft, autonomy represents both relief and risk. Self-driving cars could remove their biggest expense while also threatening the driver-based model that made them dominant in the first place.

Whether robotaxis shrink these companies or help them scale depends on who owns the cars, who controls the apps, and how cities choose to regulate what comes next.

1. Ride-hailing was built on human drivers

Uber and Lyft grew by connecting riders with everyday people willing to drive their own cars. That model scaled quickly because it avoided owning vehicles and pushed costs and risks onto drivers.

But it also locked both companies into thin margins and constant labor tension. From early on, autonomy was viewed as a long-term escape from a system that worked operationally but struggled financially.

2. Robotaxis remove the most expensive part of the equation

Labor is the single largest cost in ride-hailing. If cars drive themselves, there is no driver pay, no scheduling complexity, and no turnover.

That efficiency comes with tradeoffs. Human drivers handle edge cases and adapt instantly to changing conditions. Robotaxis promise consistency, but only if the technology performs reliably across unpredictable real-world situations.

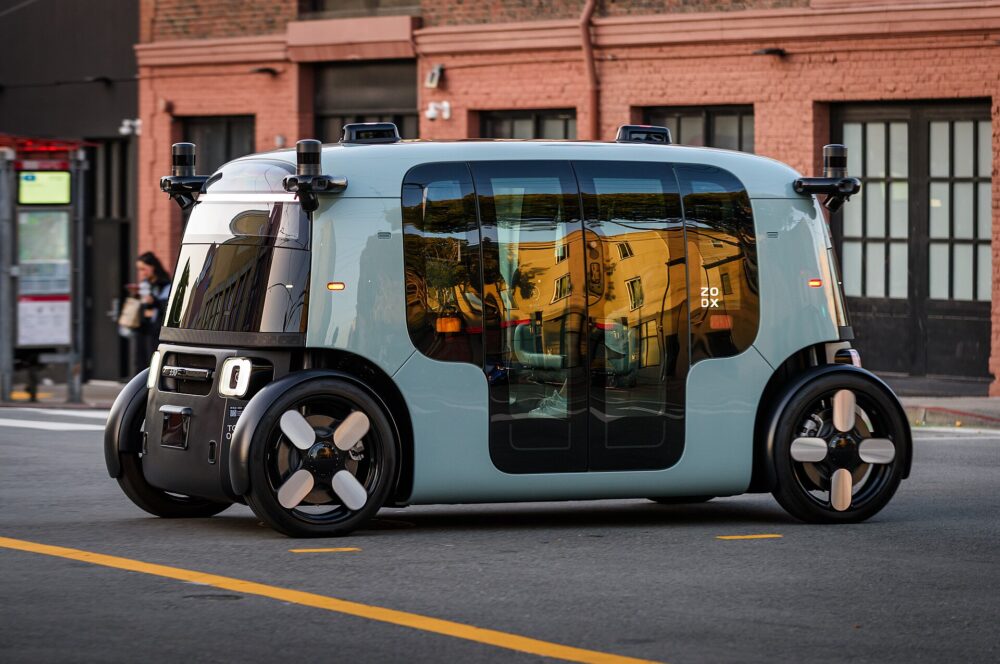

3. Autonomous fleets are already proving the concept

Several companies now operate limited robotaxi services in select cities. These are controlled environments, but they show that ride-hailing can exist without human drivers.

That reality introduces pressure. If riders accept autonomy, the question becomes whether they need Uber and Lyft at all, or just the car and the software behind it.

4. Uber and Lyft do not control the autonomy stack

Unlike maps or payments, self-driving technology is not owned by Uber or Lyft. They rely on outside partners for autonomous systems.

This creates a power imbalance. If robotaxi companies can reach riders directly, Uber and Lyft risk becoming optional platforms instead of essential ones.

5. The real battle is over platform control

The future hinges on who controls demand, not just who owns the cars. If robotaxi fleets struggle to attract riders on their own, Uber and Lyft remain powerful marketplaces that route trips, set expectations, and manage payments.

But if autonomous operators can generate demand directly, the balance shifts fast. In that case, the apps become optional layers rather than gatekeepers.

Uber argues it can be the neutral marketplace for autonomous rides, but marketplaces only win when suppliers truly need them. If robotaxis fill themselves, control quietly moves elsewhere.

6. Cities may shape the outcome before consumers do

Local governments decide permits, safety rules, and where autonomous vehicles can operate. Some cities prefer working with established platforms, while others want direct oversight.

These decisions matter. Friendly regulations could accelerate robotaxi adoption, while cautious policies could preserve the current ride-hailing structure for years.

7. Riders could see cheaper and more predictable trips

Without driver costs, robotaxis promise lower fares and fewer cancellations. Pricing could become more stable, with less reliance on surge models.

That shift benefits riders but changes expectations. Ride-hailing starts to resemble infrastructure rather than a flexible gig-powered service.

8. Drivers experience the change very differently

For millions of drivers, robotaxis represent potential job loss, not convenience. Even gradual automation can create fear and resistance.

Public backlash and labor pressure may slow adoption. The technology does not move in isolation from social and political realities.

9. Uber and Lyft may evolve instead of disappearing

Both companies have positioned themselves as broader mobility platforms, not just ride apps. Partnerships with autonomous firms could let them stay central without owning vehicles.

If they adapt quickly, autonomy could expand their reach. If not, they risk being bypassed by fleets that no longer need intermediaries.

10. The future is likely messy and hybrid

Human drivers and robotaxis will probably coexist for years. Some cities and routes favor autonomy, while others still rely on human judgment and flexibility.

This mixed model keeps Uber and Lyft relevant, but no longer guaranteed winners. Their influence depends on how well they manage the transition rather than how fast it arrives.

11. Control, not technology, decides who wins

Robotaxis alone do not determine the future of Uber and Lyft. Control over riders, data, pricing, and city relationships matters more than who builds the car.

If Uber and Lyft retain that control, autonomy could make them larger than ever. If they lose it, robotaxis will not kill them overnight, but they will slowly make them less essential.